The real estate market is always changing, making it key for homebuyers and those looking to refinance to know the latest VA mortgage rates. Bank Rates latest survey shows the average 30-year VA loan APR is 6.84%. The average 30-year VA refinance APR is 7.43% as of Wednesday, August 21, 2024.

The 30-year fixed VA loan purchase rate is now 5.750%, staying the same as last week. The 30-year fixed VA refinance loan rate is 5.990% today. VA loan rates are often lower because the government backs part of each loan, reducing the risk of default.

Things like your credit score, loan length, market conditions, and the lender can change the interest rate on a VA mortgage. It’s important for those looking to borrow to look at their finances closely. They should also compare different lenders to find the best VA loan rates for their situation.

Key Takeaways

- The national average 30-year VA loan APR is 6.84%, and the average 30-year VA refinance APR is 7.43%.

- The 30-year fixed VA loan purchase rate is currently 5.750%, unchanged from last week.

- The 30-year fixed VA refinance loan rate stands at 5.990% as of today.

- VA loan rates are typically lower than rates for other mortgage types due to government backing.

- Factors like credit score, loan term, market conditions, and lender can impact VA mortgage interest rates.

Understanding VA Loan Rates and Trends

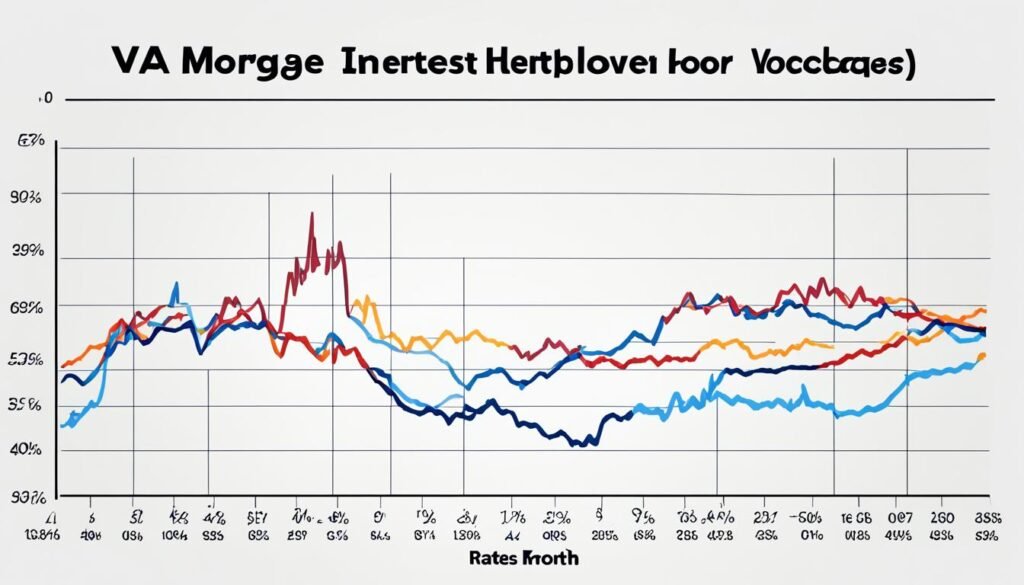

Weekly National VA Mortgage Interest Rate Trends

The changes in weekly national VA mortgage interest rate trends show how the VA loan market is always moving. Bank Rates data shows the average 30-year VA mortgage rate is now 6.80%, down from last week’s 6.99%. The average 30-year VA refinance rate also dropped from 7.51% to 7.40%.

These va loan interest rate trends change often, helping us keep an eye on the market. Remember, the rate you get can change based on your credit, finances, loan type, and lender.

| Metric | Current Rate | Previous Week | Change |

|---|---|---|---|

| 30-year VA Mortgage | 6.80% | 6.99% | -0.19% |

| 30-year VA Refinance | 7.40% | 7.51% | -0.11% |

By keeping an eye on va mortgage rate changes, borrowers can make smart choices. They can find the best loans for their financial needs and goals.

“Staying up-to-date on weekly national VA mortgage interest rate trends can empower borrowers to make informed decisions and secure the most favorable loan terms.”

current va mortgage rates

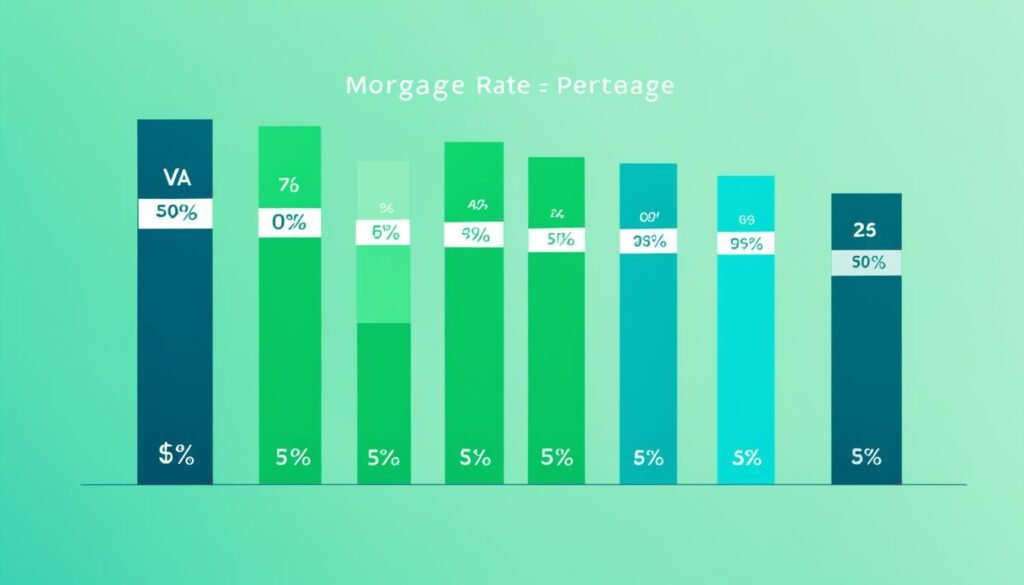

Understanding the current mortgage rates for VA loans is key. These rates change based on your credit score, loan type, and market conditions. VA loans, backed by the Department of Veterans Affairs, often have lower rates than FHA and traditional loans.

The 30-year fixed VA purchase rate is now at 5.750%. The 30-year fixed VA refinance rate is 5.990%. Remember, these rates change often, sometimes more than once a day. It’s smart to compare offers from different lenders to get the best deal.

| Loan Type | Current Rate |

|---|---|

| 30-year Fixed VA Purchase | 5.750% |

| 30-year Fixed VA Refinance | 5.990% |

Knowing the latest va loan rates today helps veterans and active-duty members make smart choices. Whether you’re buying your first home or refinancing, keeping up with current va mortgage rates and current va home loan rates can save you money. This way, you can fully benefit from the VA loan program.

“The VA loan program provides an exceptional opportunity for those who have served our country to achieve the American dream of homeownership.”

Conclusion

Understanding VA mortgage rates and trends is key for service members and veterans. They need to find the best loan for buying a home. By looking at credit score, loan type, and market conditions, borrowers can make smart choices.

VA loan rates are usually lower than other mortgages, which makes them a good option for eligible people. But, these rates can change often. It’s smart to look at different lenders to get the best deal on a VA home loan.

Keeping up with VA mortgage rate trends helps borrowers plan better. They can save money and get the best financing. By knowing about VA loan rates, service members and veterans can easily buy a home and reach their goals.